How Insurance Agency In Dallas Tx can Save You Time, Stress, and Money.

Wiki Article

Some Known Incorrect Statements About Health Insurance In Dallas Tx

Table of ContentsThe Ultimate Guide To Home Insurance In Dallas TxGet This Report on Home Insurance In Dallas TxThe Greatest Guide To Commercial Insurance In Dallas TxInsurance Agency In Dallas Tx for BeginnersAn Unbiased View of Life Insurance In Dallas TxHow Truck Insurance In Dallas Tx can Save You Time, Stress, and Money.

The premium is the amount you pay (typically regular monthly) for health and wellness insurance policy. Cost-sharing describes the section of qualified health care expenses the insurance company pays and the portion you pay out-of-pocket. Your out-of-pocket expenditures might include deductibles, coinsurance, copayments and the complete price of medical care services not covered by the plan.High-deductible plans cross groups. Some are PPO strategies while others may be EPO or HMO plans. This kind of health and wellness insurance has a high insurance deductible that you need to fulfill before your medical insurance protection works. These strategies can be appropriate for individuals who wish to save money with low monthly premiums and also do not plan to utilize their clinical insurance coverage extensively.

The downside to this kind of protection is that it does not meet the minimum essential coverage called for by the Affordable Care Act, so you might likewise be subject to the tax obligation fine. On top of that, temporary plans can omit coverage for pre-existing problems. Short-term insurance is non-renewable, and doesn't include insurance coverage for preventative treatment such as physicals, vaccinations, oral, or vision.

Little Known Facts About Home Insurance In Dallas Tx.

Consult your very own tax, accountancy, or lawful consultant as opposed to depending on this short article as tax obligation, bookkeeping, or legal advice.

You can generally "omit" any family participant who does not drive your auto, yet in order to do so, you must send an "exemption kind" to your insurance provider. Vehicle drivers that only have a Learner's Authorization are not required to be noted on your policy till they are totally accredited.

Getting My Insurance Agency In Dallas Tx To Work

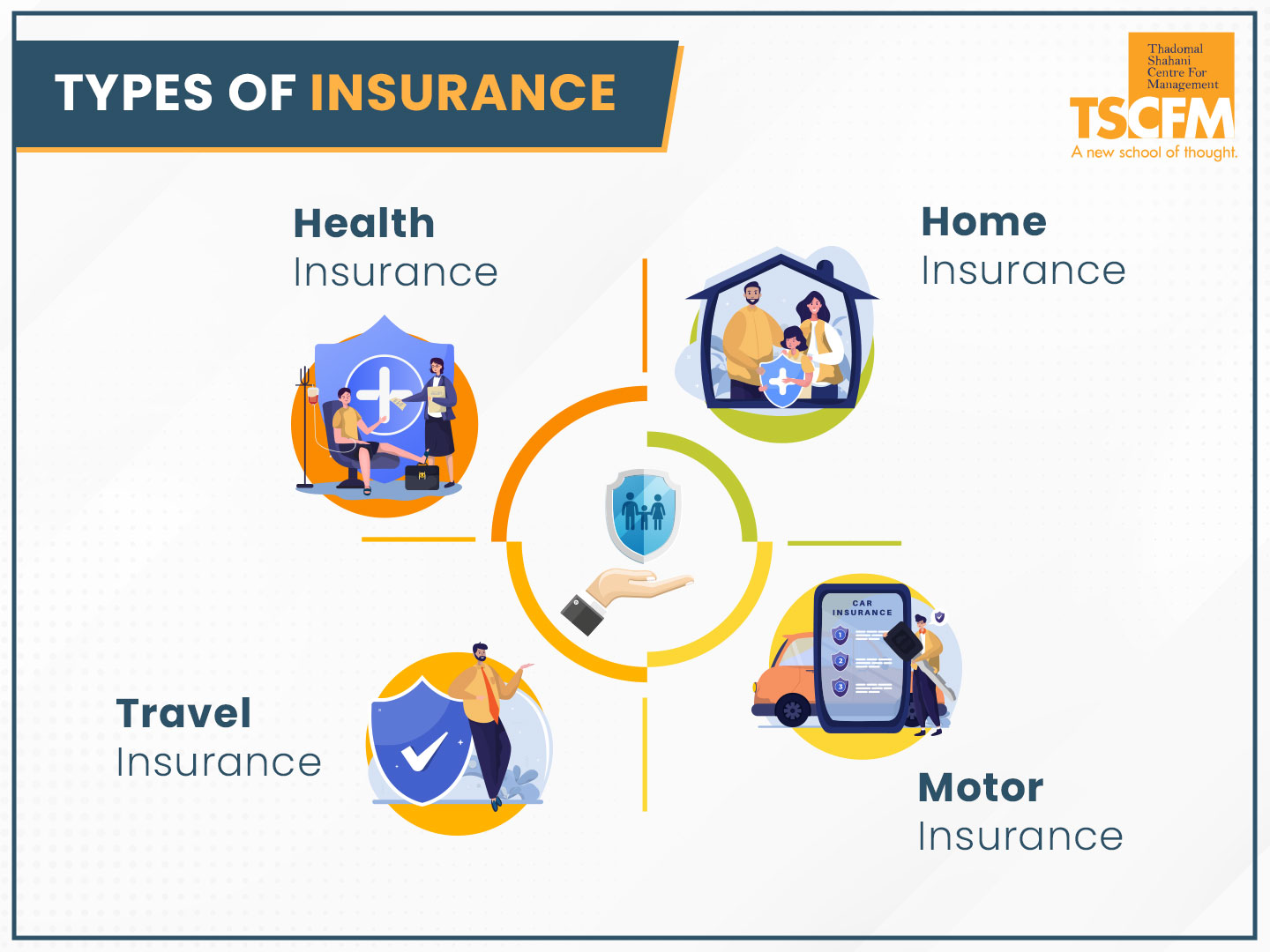

You need to get insurance coverage to protect yourself, your family, and also your wealth (Home insurance in Dallas TX). An insurance coverage can save you hundreds of dollars in case of a crash, illness, or disaster. As you hit certain life landmarks, some policies, including medical insurance and car insurance coverage, are essentially required, while others like life insurance and also disability insurance are strongly encouraged.Crashes, illness and catastrophes occur at all times. At worst, occasions like these can dive you right into deep economic destroy if you Resources don't have insurance policy to fall back on. Some insurance plan are inescapable (think: auto insurance in a lot of US states), while others are just a clever financial decision (think: life insurance policy).

Plus, as your life changes (say, you get a new task or have a child) so should your insurance coverage. Below, we've explained briefly which insurance coverage you should highly think about getting at every phase of life. Keep in mind that while the policies below are organized by age, obviously they aren't prepared in rock.

Things about Life Insurance In Dallas Tx

Right here's a quick summary of the policies you need as well as when you need them: The majority of Americans need insurance policy to manage medical care. Choosing the strategy that's right for you may take some study, but it functions as your very first line of protection versus clinical financial debt, among largest resources of financial obligation amongst consumers in the US.In 49 of the 50 US states, chauffeurs are required to have automobile insurance policy to cover any kind of possible home damage and physical injury that might result from an accident. Vehicle insurance policy prices are greatly based on age, credit, automobile make and also design, driving other record and area. Some states even consider gender.

Getting My Insurance Agency In Dallas Tx To Work

An insurance company will consider your home's area, in addition to the dimension, age and also construct of the residence to determine your insurance coverage premium. Homes in wildfire-, hurricane- or hurricane-prone locations will often command higher premiums. If you offer your home as well as return to renting, or make other living arrangements (Home insurance in Dallas TX).

For people that are maturing or impaired as well as need assist with daily living, whether in an assisted living facility or through hospice, long-term care insurance policy can assist shoulder the inflated expenses. This is the sort of thing individuals do not assume concerning up until they age and also recognize this may be a reality for them, yet naturally, as you age you obtain much more expensive to guarantee.

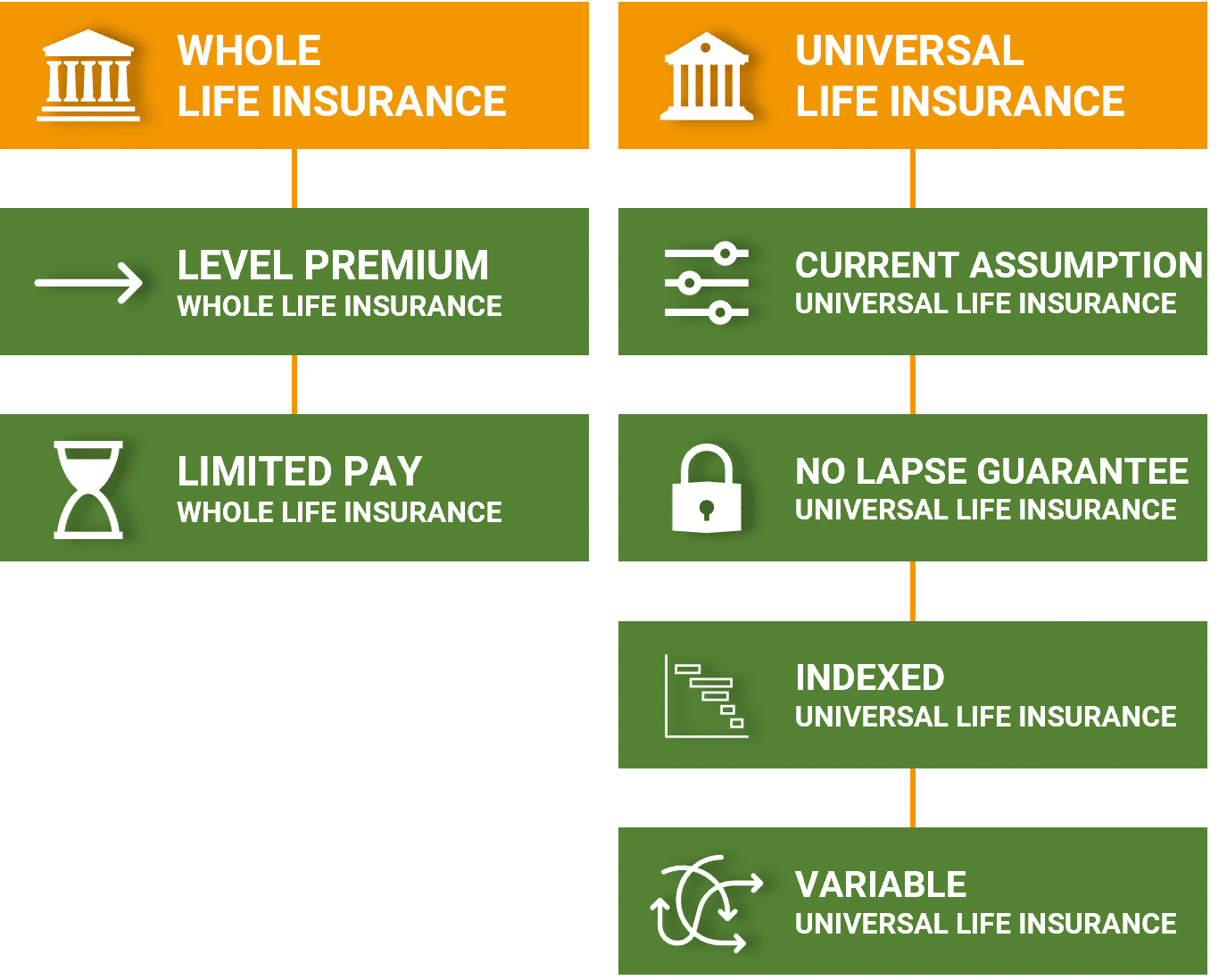

Generally, there are 2 sorts of life insurance policy plans - either term or irreversible strategies or some combination of both. Life insurers supply numerous kinds of term plans and standard life policies along with "interest sensitive" products which have become much more common given that the 1980's.

Some Known Incorrect Statements About Commercial Insurance In Dallas Tx

Term insurance supplies protection for a given time period. This period could be as short as one year or give insurance coverage for a specific variety of More Help years such as 5, 10, two decades or to a specified age such as 80 or in some situations up to the earliest age in the life insurance coverage mortality.

The longer the guarantee, the greater the preliminary costs. If you pass away during the term duration, the business will pay the face quantity of the policy to your beneficiary. If you live beyond the term period you had selected, no benefit is payable. Generally, term plans supply a death advantage without any savings element or cash money value.

Report this wiki page